Featured

Table of Contents

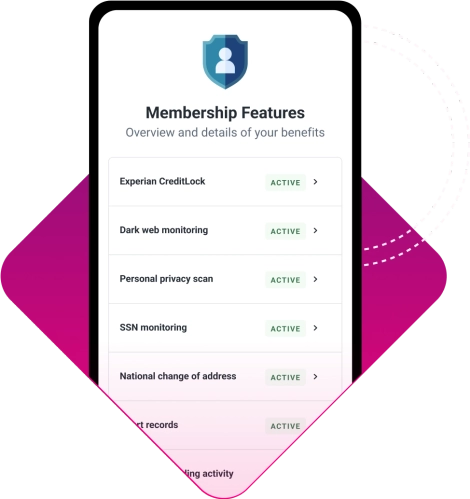

, there are a number of aspects to look for, consisting of credit report surveillance, identification tracking, identity burglary recuperation and insurance and more. They look for indications of identity burglary, such as abrupt score motion and unexpected debt questions. When they see these indicators, they inform the customer so they can take action and submit a record.

The plan might have a deductible or other exclusions or constraints; most do not cover anybody already covered by tenants or house owners insurance, which is why it's important to constantly check out the great print. If your house owners or occupants insurance coverage already covers identity burglary, after that the insurance coverage from your identity burglary protection solution might not apply

The Best Guide To Identity Protection Tools

: Finally, we have a look at where the business is based to see what security regulations it falls under. For firms based in the United States, they might be compelled to share customer information because of the U.S's membership in 5 Eyes, 9 Eyes and 14 Eyes. This will just happen in unusual instances.

Yes, somebody can steal your identity with your government-issued ID or chauffeur's license. (PII) including your complete name, home address, day of birth, picture or even your signature can be made use of to steal your identification and target you with phishing frauds.

Imagine your chauffeur's certificate number ends up being compromised and comes under the hands of somebody that makes copies of your ID and after that offers them to wrongdoers. If a criminal gets caught for any type of criminal activity with your ID, regulation enforcement could put those fees on your record instead of theirs. This scenario is really unsafe because it will be challenging to confirm that you didn't devote those criminal activities because another individual has your ID.

What Does Identity Protection Tools Mean?

If a person has your ID, they can utilize your full name to look you up and find your email address or phone number. Once they have methods to call you, someone might send you a phony message regarding questionable activity in your bank account or a concern with a social media sites profile.

You can tell if someone is using your lost or stolen ID for harmful objectives by discovering the following: A brand-new lending or line of credit score that you did not accredit appears on your credit score report, suggesting that a person has actually used your ID to commit fraud You can not visit to your on-line accounts, recommending that someone used your ID and information connected with your ID to compromise your accounts You quit receiving mail, which might be an indication someone has modified the address on your ID to match theirs You start getting telephone calls from financial debt enthusiasts concerning financial obligation that isn't your own, suggesting someone has used your ID to impersonate you and been accepted for debt cards or financings Your financial institution advises you of deceptive activity, which suggests somebody has actually utilized your ID to take out huge quantities of cash or make unauthorized purchases There are several things you ought to do if your ID has been lost or swiped, such as reporting the loss or burglary to your state's DMV, freezing your debt and filing a record with the Federal Trade Compensation (FTC).

You should report your ID as swiped - click here to the Federal Trade Compensation (FTC), which will certainly use the details you supply to collaborate with police in investigating your identification burglary. It is necessary to file a report with the FTC asap so the FTC can share your experience with police to help recoup your identity and utilize the details from your case to aid secure others

Our technology team has years of experience with LifeLock, and we have actually come to be incredibly familiar with what they offer. Their most thorough plan, Ultimate And also, supplies extensive protection and identity burglary resolution solutions that need to cover the demands of most senior citizens. We got text, phone, and mobile app alerts whenever there was a possible information breach or misuse of our personal information.

Identity Protection Tools for Beginners

Not all LifeLock plans, nevertheless, provide the same level of protection. The Criterion plan is somewhat very little in its offerings, but you can still get up to $1.05 million in identification burglary insurance, together with Social Protection number, credit history, and monetary surveillance. If you're out a limited budget plan, you can obtain more functions with among the more expensive plans, such as: Insurance coverage for approximately two grownups As much as $1 numerous coverage for legal costs (per grownup) Up to $1 million in personal cost repayment (per grownup) Approximately $1 million in stolen funds compensation (per adult) Up to $3 million in complete coverage Three credit history bureau surveillance Cash advance car loan lock to quit deceptive high-interest car loans Alerts for criminal offenses committed in your name Social media site monitoring Financial and investment account surveillance Contact number security Home title monitoring LifeLock includes 3 identity burglary protection bundles ranging from $11 - click here.99 to $69.99 monthly for the initial year of solution

The price cuts drop after the initial year of service. The Requirement plan, for instance, costs $89.99 for the first year, and afterwards $124.99 for every year after that. You're still getting a discount rate by paying annually, yet it's far less from the 2nd year onward. With the addition of antivirus solutions and high repayment amounts, though, LifeLock's expense is fairly sensible.

Latest Posts

The Facts About Identity Protection Tools Revealed

Things about Identity Protection Tools

Identity Protection Tools for Dummies